The sum insured limit of personal accident insurance varies from one plan to another. It is best to check the terms and conditions of your desired policy or contact the insurance company to know the sum insured limit.

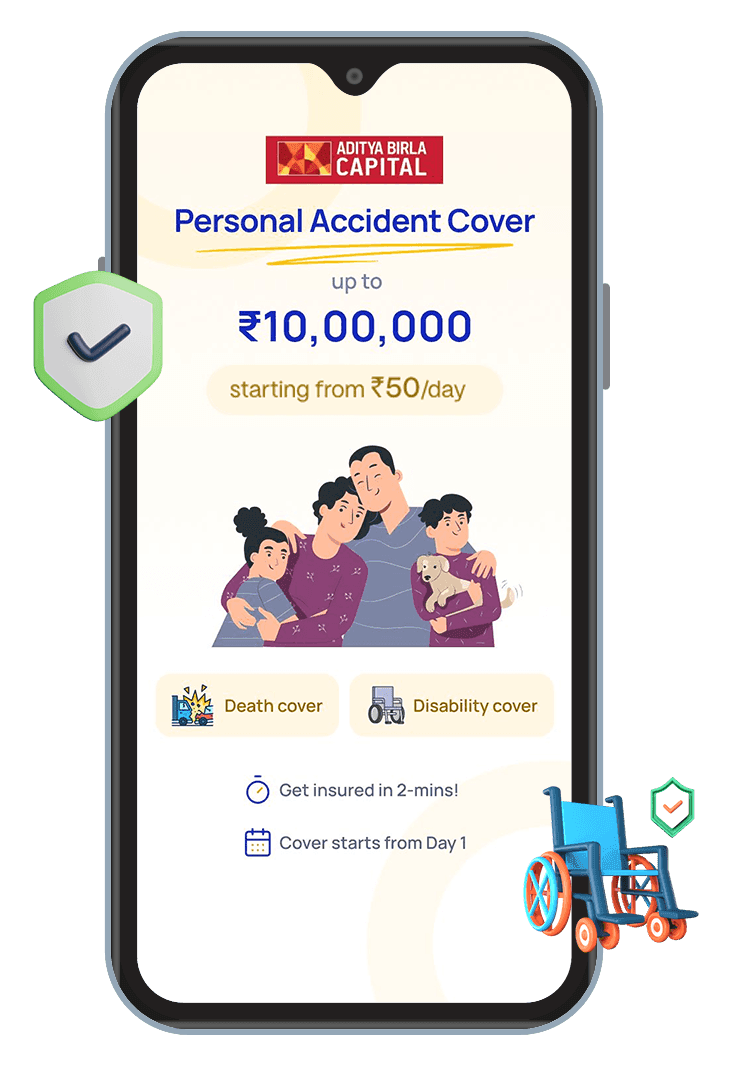

Powered by Aditya Birla Health Insurance

Benefits of Accident Cover

Apply in few easy steps

What is covered?

A personal accident insurance policy covers the following:

1. Accident Death

In case an accident leads to the death of the policyholder, the entire sum assured is paid to the nominee or the legal heir.

2. Permanent Total Disability

In case an accident results in permanent disabilities or lifelong total impairment, such as loss of both limbs, then a specified sum insured amount is paid to the policyholder.

3. Permanent Partial Disability

If an accident results in permanent partial disabilities, then a certain percentage (up to 100%) of the benefit is paid to the policyholder.

Got Questions? Let's get to them.

What is the limit of personal accident insurance?

Is it worth having a personal accident cover?

Yes. Accidents are unpredictable and can lead to death or permanent disabilities. By buying a personal accident plan, you get compensation for permanent or temporary disabilities to cover medical bills and replace loss of income. It also pays compensation to your family in case of your unfortunate demise.

Is a personal accident cover mandatory?

No. Buying a personal accident cover is not mandatory under health insurance.

Can I buy 2 personal accident insurance?

Yes. You can buy two personal accident insurance policies in India